Sales tax collection requirements for US sellers can be a complicated affair. This is because, as you may know, the United States has no national sales tax. Instead, sales tax in the US is governed by 45 different state-level tax laws plus Washington DC, which, although not a state, operates as such with regards to sales tax. Additionally, there are five tax-exempt states to consider.

[Image Source]

As a US seller or an international eCommerce business looking to sell in the US, it’s important to understand the sales tax collection requirements per state. This includes knowing which state to register in, which products are or aren’t exempt and what the shipping tax requirements are at a state level.

The main sales tax aspects that may differ from state to state are due dates, the frequency for sales tax collection and returns, the percentage of sales tax charged and which products are taxable.

In this guide we will take you through all the sales tax collection requirements for US sellers in 7 steps so that you understand how to determine:

- Your sales tax nexus

- Which products are subject to sales tax

- How to register for sales tax permits

- Your shipping taxability

- How to set up tax collection from carts and marketplaces

- Your tax reporting and filing requirements

- Must-use tax automation tools

Let’s get started!

Step 1: Determining Your Sales Tax Nexus

Your sales tax nexus refers to the state you will ‘tie’ your business to. In other words, it determines which states your sales tax nexus is tied to, therefore determining which states you’ll be paying sales taxes to. There are two sale tax nexus terms to consider: physical and economic.

Physical Nexus, also referred to as ‘sufficient physical presence,’ is the legal term that outlines the tax requirements of doing business in a state. For example, if you sell products in LA, you would file and pay taxes in California.

Economic Nexus is based on whether your seller has an economic presence or income (from sales) in a specific state. For example, if you sell products in LA over a certain revenue threshold, despite having a physical nexus in New Jersey, you may be liable for sales taxes. This is the newest form of nexus in the US, only having come into effect at the end of June 2018.

Determining your sales tax nexus for your brand will be based on any of these factors:

- Affiliates: These would be local businesses or service providers who advertise or sell your products for a percentage of the profits generated from sales. This means if you’re using Google Adsense affiliate marketing to drive traffic to your business, for example, a click-through nexus (nicknamed ‘The Amazon Law’) may apply.

- Dropshipping: If you have drop shipping or third-party shipping fulfillment companies, such as Amazon FBA or ShipHero, within a specific state.

- Inventory: Where your inventory is warehoused. Most states consider inventory storage locations as the main nexus determinator regardless of where your business or personal residence is located. This means that if you’re using third-party fulfillment services, in most cases your nexus will be in the state where they store your products.

- Location or physical presence: Where your office, store, warehouse or any other physical place of business is located.

- Personnel: The state in which your employees, installers, contractors or salespeople are located can determine your nexus. This means that if you have remote workers across the US, you could trigger nexus in a variety of states.

- Sales: Sales will determine your economic nexus. About 50% of US states require that sellers who earn over a certain sales threshold (normally reaching $100,000 revenue or 200 sales transactions annually) will be required to pay sales tax to that state.

- Trade shows: Selling your products at events and trade shows may mean you will be liable for tax in that state, even if selling temporarily. This can also include out-of-state meetings, conferences, sales calls, etc.

For new US-based sellers, your ‘home’ state would most probably be your nexus trigger. For international or national sellers using in-house or fulfillment services, your warehouse will likely trigger a nexus for each state your inventory is housed in.

Step 2: Determining Which Products are Subject to Sales Tax

Once you know which state nexus you have, you will need to determine which products are or are not tax exempt according to the state you’re selling in. For example, groceries will probably not be taxable in more states.

Other types of products that could be sales tax-exempt in various states include clothing, certain textbooks or religious books, some medication and supplements, and digital products like music, photos, eBooks, and magazine or newspaper subscriptions. It’s important to stay on top of which products are taxed in what state as this changes all the time. If you want to check all the tax info for each nexus state, TaxJar’s clickable state sales tax map is very handy.

Step 3: Registering Sales Tax Permits

Once you know which state or states you have nexus in, and which products within those states are taxable, it’s time to register for your tax permits. This will enable you to legally collect (and pay) taxes for the nexus state. Each taxing authority (State Department of Revenue) will handle that state’s permit registration and this can either be done by yourself or through services such as TaxJar or Avalara.

Each state’s sales tax authority will have different requirements and registration will differ slightly. But as a general rule, it can take 1-10 business days to get your sales tax permit number and up to four weeks to get your sales tax permit. The minimum documents the State Department of Revenue may request are:

- NAICS code (which is 454110 for online sellers)

- Personal and business contact info

- Business entity details (LLC, S-Corp, sole proprietor, etc.)

- Your SSN (Social Security Number) or FEIN (Federal Employer Identification Number)

Once you have successfully applied for and received your sales tax permit, you will be given your sales tax filing frequency (monthly, bi-monthly, quarterly, bi-annually or annually) and due dates. this will fall on different days of the month depending on the state. Frequency is likely to differ from state to state and could change, so always play close attention to due dates to ensure you’re not late with payments.

For example, Colorado's taxable period for January would be from the 1st to the 31st of January, with a February 20th payment due date for that tax period. If you’re selling nationally, you can call and negotiate with specific states’ taxing authorities on the frequency of tax payments.

Bonus Tip: For most states, your sales tax permit will also serve as your resale certificate. This means that for those states where you have a valid tax permit, you may be able to buy tax-free products as long as your intent is to resell them. Check with your nexus state or states about what their resale certificate guidelines are for retailers.

Step 4: Understanding Shipping Taxability

Next, you will need to consider shipping tax for your nexus state. Each state will have different shipping taxation policies, with some requiring a small tax amount for the shipping amount charged, while others won’t consider shipping charges taxable.

[Image Source]

Let’s say you’re selling a t-shirt for $10 with a $5 shipping fee:

- If the state you’re shipping to has shipping tax, you would charge 5% sales tax on the full $15. Therefore, you would be charging your customer $15.75 (including shipping and taxes).

- If the state you’re shipping to doesn’t require that shipping costs be taxable, you would then charge 5% sales tax on the t-shirt ($10) only, bringing it to $10.50 ($10 + 5% sales tax). You would then add the shipping charge, making the total cost for your shopper $15.50.

In short, this means when setting up your tax collection for your sales channels you will need to indicate whether you’re charging shipping sales taxes for each location, while also taking into consideration things like gift wrapping.

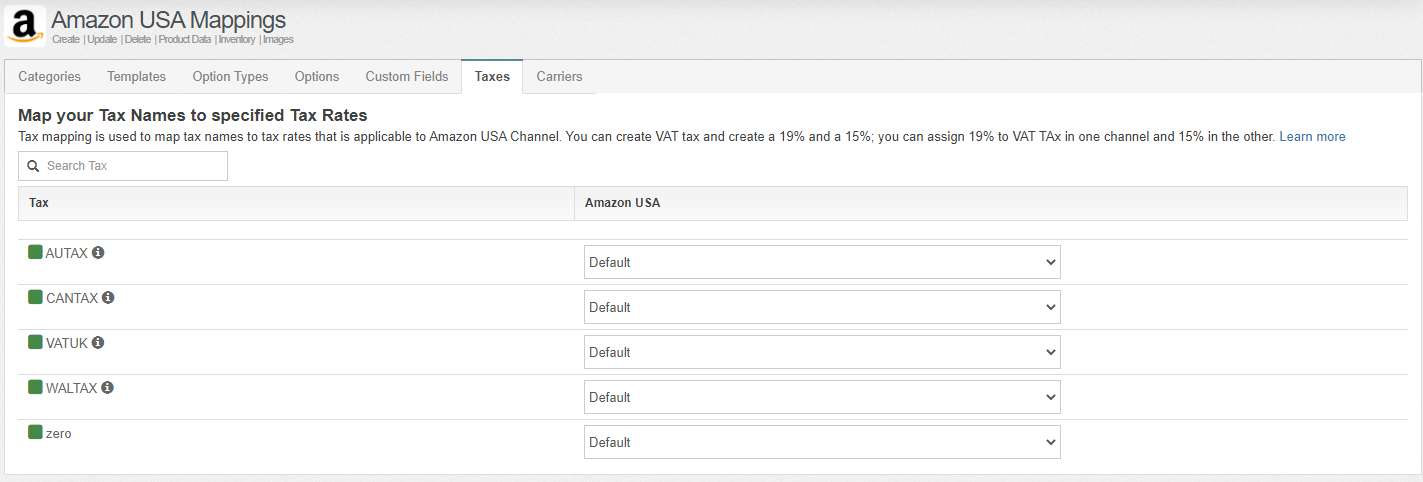

The best way to do this is with a multichannel management tool such as StoreAutomator. Our platform includes a comprehensive tax mapping functionality that enables you to adapt your prices according to where you’re shipping from and where you’re shipping to, all on a channel basis.

This includes Amazon, Walmart, and eBay integrations.

Step 5: Understanding Dropshipping Tax Implications

The next thing you will need to consider is whether you’re drop shipping any of your products. Dropshipping is a popular eCommerce business model but can cause some sales tax complications for US sellers. Let’s use the t-shirt example again and assume that you use a third-party printing and fulfillment service, such as Printful, to fulfill your orders. If your fulfilling service is in your nexus state, you will pay sales tax to them - unless you’re able to present them with a resale certificate.

Additionally, if the customer buying your shirt is in the same tax nexus as you and the fulfillment service provider, they will need to pay tax. Drop shipping is complicated because you will need to consider where your business, the third-party vendor and your shopper’s locations are.

Step 6: Setting Up Tax Collection for Shopping Carts and Marketplaces

Now it’s time to set up your tax collection from shopping carts and channels. But first, you will need to determine your tax collection method. As you have seen, you will need to specify the following for each and every product you sell:

- Whether the product is taxable and by how much, according to the state

- If the shipping costs need to be taxed, based on where the product will be sent

- Whether the customer is within or outside of your nexus state

Regardless of what your nexus states are, you will need to consider these two main collection methods: destination-based and origin-based sales tax collection. These ‘methods’ are referred to as sales tax sourcing, and different states will have different requirements. Here’s a breakdown on each:

Destination-Based Sales Tax Collection

If you are based in a US state that requires destination-based sales tax sourcing, you will need to charge the tax rate of the address the product is being shipped to.

Origin-Based Sales Tax Collection

If you are based in a US state that requires origin-based sales tax sourcing, you will need to charge the tax rate based on where your products are being shipped from. This is a much simpler form of tax sourcing, however as you can see below, it only applies to a few states.

[Image Source]

Step 7: Tax Reporting and Filing

Finally, when it comes to sales tax collection requirements for US sellers, reporting and filing are super important. Incorrect collection or late filing can result in big penalties and interest, which can really hurt your bottom line. If you are in a state with origin-based tax supply, this will be easier to get a handle on. However, most multichannel sellers who are selling in high volumes around the US will probably require you to provide a breakdown of sales tax by county or city.

Whichever state tax nexus you’re in, or which collection tax supply that state implements, always report and file on time. Most states allow for online filing these days, but many will have different regulations on how to make payments. Such as requiring you pay via EFT and ensuring the money is in their account by a certain date or pay both a fine and a daily interest on amounts owing.

Conclusion

There you have it, sales tax collection requirements for US sellers. We strongly suggest that you make use of our tax mapping function and other tools like TaxJar to ensure you’re fully compliant, collecting correctly and always pay on time.

Bonus Tip: Non-US Sellers Tax Compliance

If you’re a seller who isn’t located in the US, you will need to do the following to ensure you’re US tax compliant:

- Determine where you have nexus (as shown above)

- Register for your sales tax permit in your nexus state(s)

- Open a US bank account